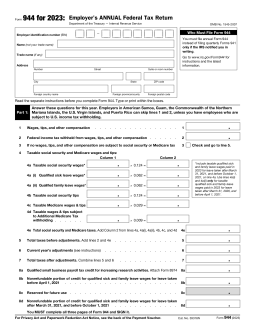

Updated December 08, 2023

A Form 944 (Employer’s Annual Federal Tax Return) is an IRS document commonly used by small employers whose annual liability for Social Security, Medicare, and federal income taxes is less than $1,000. With Form 944, employers report and pay their owed taxes to the IRS once a year instead of quarterly. Only those notified in writing by the IRS may file a Form 944.

Who Can File Form 944?

Small businesses with an annual payroll tax liability of $1,000 or less can file Form 944. The IRS must approve this use in writing.

Table of Contents |

What is Form 944?

Form 944 is an IRS document that approved small businesses can use to report federal payroll taxes withheld from employees’ wages on an annual basis.[1]

Employers must report the following information on Form 944:

- Total wages paid to employees during the tax year

- Total tips reported by employees during the tax year

- Federal income tax withheld from wages

- Social Security and Medicare tax liabilities

- Additional Medicare Tax withheld from employees

- Adjustments to Social Security and Medicare taxes for fractions of cents, sick pay, tips, and group-term life insurance

- Qualified small business payroll tax credit for research activities

Who Files Form 944?

Only small employers who have been specifically directed by the IRS can file Form 944. Typically, the IRS will send a written notice to a business to file Form 944 if its annual tax liabilities are less than $1,000.

When applying for an Employer Identification Number (EIN), a business is typically assigned a specific employment tax return to file. If it was not assigned, the employer must file Form 941 by default until directed otherwise by the IRS.[2]

Eligibility

A business may be eligible to file Form 944 instead of Form 941 if its employment taxes for the calendar year are projected to be less than $1,000. Based on current tax rates, the total wages paid for the year would be $5,000 or less.[3]

To make a request for annual filing instead of quarterly, call the IRS at 800-829-4933 by April 1 of the current year. Businesses may also send a written request, postmarked by March 15 of the current year, to:

Department of Treasury

Internal Revenue Service

Ogden, UT 84201-0038

or

Department of Treasury

Internal Revenue Service

Cincinnati, OH 45999-0038.

Exceptions

The following are not eligible to use Form 944 regardless of their annual tax liability:[4]

- Household employers

- Agricultural employers

Deadlines

Form 944 is due once a year by January 31, following the end of the calendar year.

For businesses that have made timely deposits in full payment of the owed taxes by January 31, the IRS gives a filing deadline extension of 10 calendar days.[5]

2024 Deadlines

January 31, 2024, or February 10, 2024 for filers who have already paid their taxes in full.

Where to File Form 944

Online

The IRS recommends filing Form 944 electronically. To e-file Form 944, use IRS-approved software to complete and submit the return. An authorized e-file provider can also be used to file it on your behalf. A fee may be charged to file electronically.

Where to Mail

If filing by paper, the mailing address for the return depends on whether a tax payment is included with Form 944.[6]

| States | Without a Payment | With a Payment |

|---|---|---|

| Connecticut, Delaware, District of Columbia, Georgia, Illinois, Indiana, Kentucky, Maine, Maryland, Massachusetts, Michigan, New Hampshire, New Jersey, New York, North Carolina, Ohio, Pennsylvania, Rhode Island, South Carolina, Tennessee, Vermont, Virginia, West Virginia, Wisconsin | Department of the Treasury

Internal Revenue Service Kansas City, MO 64999-0005 |

nternal Revenue Service

P.O. Box 806532 Cincinnati, OH 45280-6532 |

| Alabama, Alaska, Arizona, Arkansas, California, Colorado, Florida, Hawaii, Idaho, Iowa, Kansas, Louisiana, Minnesota, Mississippi, Missouri, Montana, Nebraska, Nevada, New Mexico, North Dakota, Oklahoma, Oregon, South Dakota, Texas, Utah, Washington, Wyoming | Department of the Treasury

Internal Revenue Service Ogden, UT 84201-0005 |

Internal Revenue Service

P.O. Box 932100 Louisville, KY 40293-2100 |

| No legal residence or principal place of business in any state |

Internal Revenue Service

P.O. Box 409101 Ogden, UT 84409 |

Internal Revenue Service

P.O. Box 932100 Louisville, KY 40293-2100 |

| Special filing address for exempt organizations; federal, state, and local governmental entities; and Indian tribal governmental entities, regardless of location |

Department of the Treasury

Internal Revenue Service Ogden, UT 84201-0005 |

Internal Revenue Service

P.O. Box 932100 Louisville, KY 40293-2100 |

Form Parts (6)

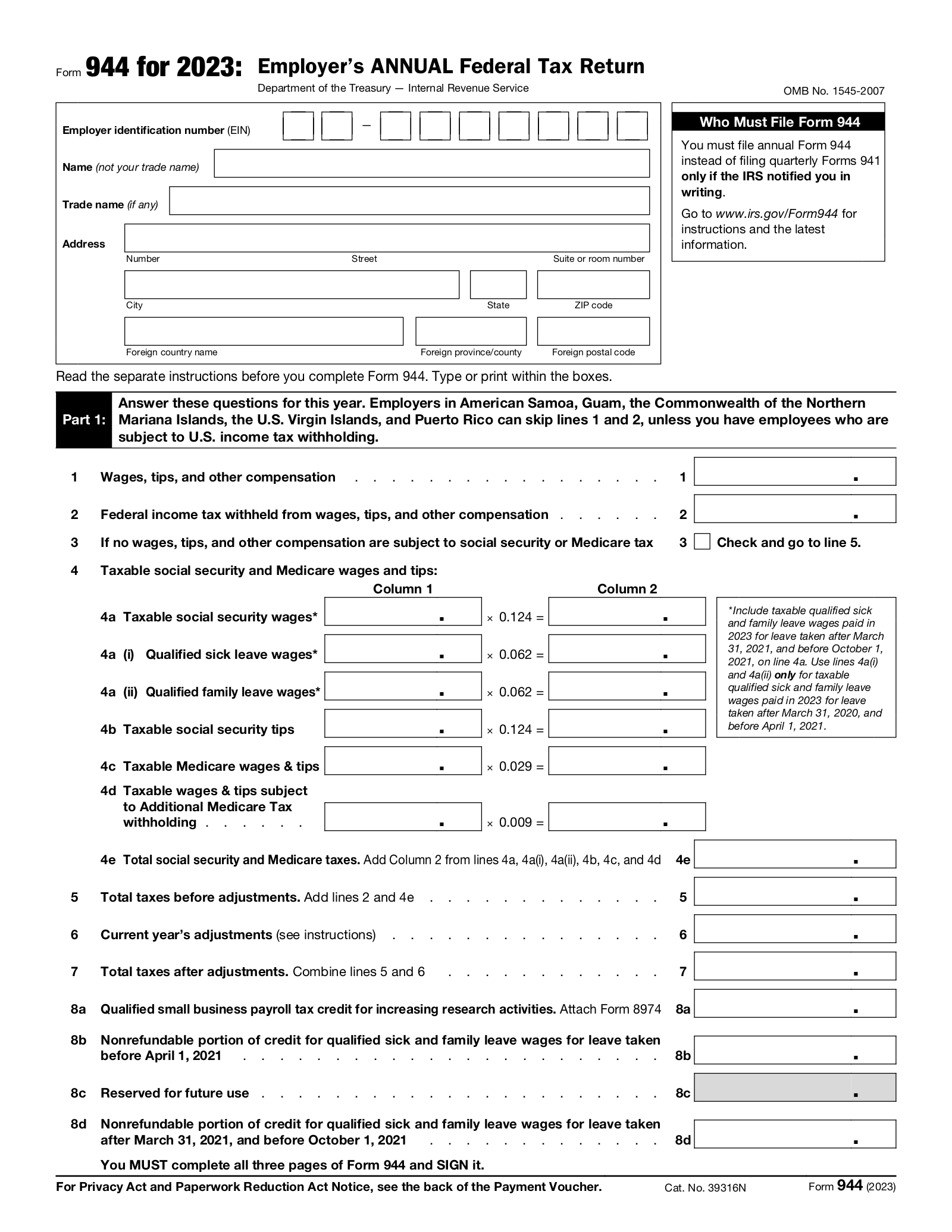

Part 1: Calculating Balance Due

The first section asks for all the important figures from the year to determine the total amount that the employer owes the IRS, including:

- Number of employees who earned wages during the tax year

- Total wages, tips, and other compensation paid

- Social Security and Medicare taxes withheld from paychecks

- Total adjustments for sick pay

- Refundable and non-refundable credit for qualified sick and family leave wages

Part 2: Deposit Schedule and Tax Liability

Skip this section if your total taxes after adjustments and non-refundable credits are less than $2,500. If it’s more than $2,500, fill out your tax liability for each month.

If you are a semi-weekly depositor or if your tax liability exceeds $100,000, complete Form 945-A instead of this section.

Part 3: Information about the Business

This section asks if your business has closed or stopped paying wages. You may also include any qualified health care expenses allocable to qualified family leave or sick leave wages in the specified periods in 2021. Leave the line blank if the question does not apply to your business.

Part 4: Third-Party Designee

Indicate whether you consent to a designated third party, such as an employee or a tax preparer, to discuss the return with the IRS. If yes, provide the designee’s name, phone number, and PIN.

The third-party designee may:[7]

- Provide the IRS with any information that is missing from the return

- Contact the IRS for information about processing the return

- Respond to certain IRS notices about errors

Part 5: Signature

Print and sign your full name, along with your official title. Provide a daytime contact phone number and the date.

Depending on the business type, the person authorized to sign the return may vary:[8]

- Sole proprietorship — The owner of the business.

- Corporation (including an LLC treated as a corporation) —The president, vice president, or other principal officer duly authorized to sign.

- Partnership (including an LLC treated as a partnership) or unincorporated organization — A responsible and duly authorized partner, member, or officer having knowledge of its affairs.

- Single-member LLC treated as a disregarded entity for federal income tax purposes — The owner of the LLC or a principal officer duly authorized to sign.

- Trust or estate —The fiduciary.

Form 944 may also be signed by an agent of the taxpayer authorized by a valid power of attorney.

Payment Voucher (944-V)

Complete this section if your net taxes for the year are:

- Less than $2,500 and you’re paying in full with a timely filed return.

- More than $2,500 and you already deposited the taxes you owed for the first, second, and third quarters of 2022; your net taxes for the fourth quarter are less than $2,500; and you’re paying, in full, the tax you owe for the fourth quarter of 2022 with a timely filed return.

You may also complete this section if you’re a monthly schedule depositor making a payment of $2,500 or more in accordance with the Accuracy of Deposits Rule.[9]

Frequently Asked Questions (FAQs)

What’s the difference between Form 941 and Form 944?

Both forms are used by employers to report their payroll tax liabilities. However, Form 944 is used to report them only once a year, while Form 941 is used to report quarterly (every three months).

Form 944 is generally reserved for businesses whose annual tax liabilities are less than $1,000.

What is the penalty for filing Form 944 late?

The IRS charges a penalty of 5% of the total tax assessed for each month the tax return is filed late for up to five months.[10]

How do I correct a Form 944 that I already filed?

To make any corrections on Form 944 after you’ve filed it, complete and file a Form 944-X.

Sources

- IRS – Instructions for Form 944 (2022): Purpose

- IRS – Certain Taxpayers May File Their Employment Taxes Annually

- IRS – Instructions for Form 944 (2022): Requesting To File Form 944 in Future Years

- IRS – Instructions for Form 944 (2022): Exceptions

- IRS – When Will I File Form 944?

- IRS – Instructions for Form 944 (2022): Where Should You File?

- IRS – Instructions for Form 944 (2022): Part 4

- IRS – Instructions for Form 944 (2022): Part 5

- IRS – Publication 15 (2023), (Circular E), Employer’s Tax Guide: Accuracy of Deposits Rule

- 26 U.S. Code § 6651(1)